FLORIDA STATED INCOME LENDERS PROVIDING FAST & EASY APPROVALS

STATED FLORIDA INVESTOR MORTGAGE LENDERS

No Income Verification Commercial Mortgage Lenders

STATED INCOME MORTGAGE LENDERS FOR PRIMARY HOMES = CLICK HERE

A true Florida Stated Income Mortgage lender is perfect if you do not have to provide tax returns. If for whatever some reason you cannot or do not want to provide tax returns because of excessive write off keep you from qualifying at your local bank mortgage. No Problem, We don’t care about your tax returns and we do not care about your debt to income ratio (DTI). Our Stated income loan program lets you purchase or refinance up to 85% of your Florida Home Purchase!

Stated Investor Mortgage Lenders – Loans Based On Rental Property Income!

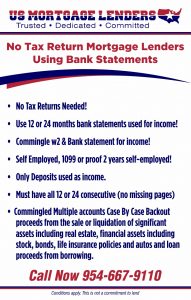

Details of Florida Bank Statement Only Lenders Program:

- Must have 12 consecutive months of statements (no gaps)

- Must provide All pages (even the last pages with advertising)

- If the account was used and closed and new account for the remainder of statements must show the closing of old account and the opening of the new account

Florida Stated Income Loans for Florida Home Buyers!

(Florida Properties must be located within 20 Miles of a population of 100,000 or more)

Florida Stated Lenders Loan Approval Property Types:

- 1-4 Florida single family homes including condo’s.

Florida Stated Loan Investor Amounts:

- $100,000 to $1,00,000 for 1 units and Florida condos

- $100,000 to $2,000,000 for 2-4 units

Stated Florida Lenders Maximum (LTV) Loan To Value

- 70% = Min 30% Down payment required.

Florida Stated Loan Investor Transaction Types Include:

- Purchases 2-4 units– OK!

- Refinance Florida Properties 1-4 units– OK!

- Cash Out Refinance– OK!

- Stated Income – OK!

- No Tax Returns – OK!

- Previous Bank Turn Down – OK!

- Multiple investment properties owned – OK!

Minimum Fico Score Required:

- 640 Minimum Mid-FICO – There is a high number and low number the number in the middle must be min 640

Florida Stated Loan Investor Terms:

- 30 years / due in 30 years (30/30)

- 3- 8 years fixed – adjustable year 4 through 30!

Florida Stated Loan Investor Interest Rates:

- Rates starting at the 7% range fixed for 36 months, adjustable 6 months.

- Interest Rates buy-downs are available.

The prime rate will move up or down in lockstep with changes by the Federal Reserve Board. What it means: The initials stand for The Wall Street Journal, which surveys large banks and publishes the consensus prime rate. The Journal surveys the 30 largest banks, and when three-quarters of them (23) change, the Journal changes its rate, effective on the day the Journal publishes the new rate. It’s the most widely quoted measure of the prime rate, which is the rate at which Florida banks will lend money to their most-favored customers.

How it’s used: The prime rate is an important index used by banks to set rates on many consumer loan products, such as credit cards or auto loans. If you see that the prime rate has gone up, your variable credit card rate will soon follow.

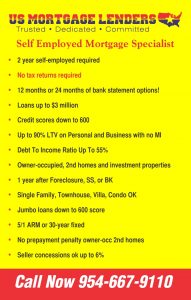

FLORIDA STATED INVESTOR LOANS

Commercial stated Florida mortgage lenders provide investors with the opportunity to take advantage of the Florida real estate market. Typical stated Florida mortgage transaction take approximately 3-6 weeks to complete from contact to closing. Florida stated investor lenders can provide fast funding for Florida business owners or professional Florida real estate investors. Recently Florida mortgage lenders and local Florida banks are very critical on approving stated Florida investor loans on investment type Florida investment properties. Florida stated mortgage lenders not only calculate properties the Debt Service Coverage Ratio but the owner’s or buyer’s personal Debt To Income Ratio. As a result, many Florida self-employed borrowers with a lot of write-offs cannot qualify for investor loans to purchase or refinance income producing Florida properties.

Florida -Bank Statement Only Mortgage Lenders

- Bank Statement Only Florida Mortgage Lenders

- bank statement only – Florida-Mortgage-Lenders.com

- Florida -Bank Statement Only Mortgage Lenders

- BANK STATEMENT LOAN PROGRAM DETAILS – Florida-Mortgage

- STATED FLORIDA MORTGAGE LENDERS-

- Florida -Bank Statement Only Mortgage Lenders

- Stated INcome Florida Mortgage Lenders

- No Tax Return Florida Mortgage Lenders

15% DOWN+STATED INCOME FLORIDA MORTGAGE LENDERS-www.florida-mortgage-lenders.com/florida-mortgage…/186-stated-florida-mortgage-l…”There are two main problems that self-employed Florida borrowers face when qualifying for a Florida mortgage,” “First, you need to prove their income with tax returns rather than using a ‘stated income’ loan. Second, the recent housing recession has caused declining income for many self-employed business owners.

Florida Stated Mortgage Lenders – Florida-Mortgage-Lenders.com

www.florida-mortgage-lenders.com/…/tags/…/910-florida-stated-mortgage-lenders.ht…Stated Florida Mortgage Lenders – Same Day Pre-Approvals in every city in Florida. The Stated Florida Mortgage Lenders only loan program is for home buyers …

Florida stated income mortgage lenders + same day approval!

www.fhamortgageprograms.com/stated-income-florida-investor-loans/Dec 23, 2016 – FLORIDA STATED INCOME PRIMARY HOMES AND INVESTOR LOANS Call NOW 954-667-9110 Same Day Florida stated income loan Pre …

Stated Income Florida Mortgage Program Details

www.florida-mortgage-lenders.com/…mortgage…/3583-stated-income-florida-mortga…As with many traditional loans, stated income Florida mortgage loans may be a 30-year fixed interest or ….. NEW PORT RICHEY FL MORTGAGE LENDERS.