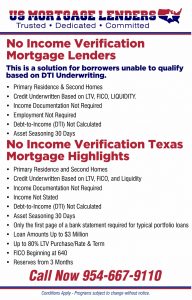

Florida No Income Verification Mortgage Lenders

Florida No Doc, No Income Verification Mortgage — How Do I Get a Florida Mortgage NO Tax Returns?

How Do I get a Mortgage In Florida With No Tax Returns?

How Do I get a Mortgage In Florida With No Tax Returns? Florida Bank Statement Mortgage Lenders

Florida Bank Statement Mortgage Lenders Stated Income Documentation up to $1.5 million!

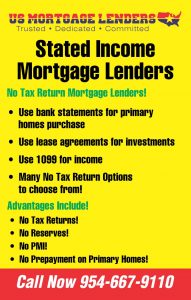

Stated Income Documentation up to $1.5 million!

24 Months Bank Statement Florida Mortgage Lenders

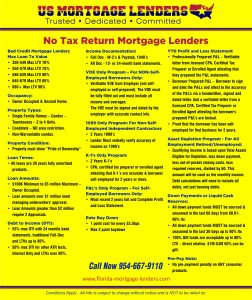

24 Months Bank Statement Florida Mortgage Lenders Personal Statements: Qualify using 24 avg bank statements. We use 100% of the deposits as income. Business Statements: Read More »

12 Months Bank Statement Florida Mortgage Lenders

12 Months Bank Statement Florida Mortgage Lenders Business Statements: Qualify 12 months’ Avg Deposits. Up to 90% are subject to a Business bank statement questionnaire. Read More »

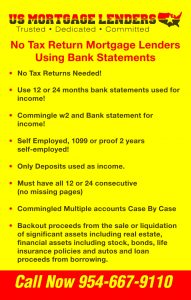

Florida – Bank Statement Only Mortgage Lenders – NO Tax Returns!

- 12 or 24 months of personal bank statements.

- 12 or 24 months business bank statements w/P&L.

- Asset Xpress program – use assets as income.

- Asset Assist program – use assets as additional income.

- Lease agreement in lieu of Schedule E.

- Up to 55% DTI.

- Up to 90% LTV.

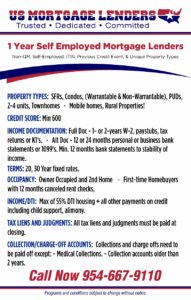

Tax deductions combined with tough documentation requirements make conventional mortgage loan approval difficult to obtain for self-employed mortgage applicants. Today, Florida self-employed mortgage applicants are using Stated income mortgage loans to qualify using assets and credit to qualify.

Another option is Bank statement-only loans are loans where self-employed lenders use bank statement deposits to verify the mortgage applicant’s ability instead of tax returns, to determine the self-employed mortgage applicant’s ability to repay the mortgage loan. Florida bank statement-only mortgage lenders work with self-employed Florida mortgage applicants to calculate bank statement deposits for 12 to 24 months. Every self-employed Florida mortgage lender uses a slightly different formula to determine a self-employed applicant’s qualifying income. In most cases, in qualifying with personal bank statements mortgage lenders will use 100% of deposits in a personal bank account. And an expense ratio is determined when using business bank statements to qualify.

LINKS OF INTEREST

- Bank Statement Only Florida Mortgage Lenders

- FLORIDA BANK STATEMENT ONLY MORTGAGE LENDERS

- 15% Down Bank Statement Only FL Mortgage Lenders

- Bank Statement Only Florida Mortgage Lenders Min 600+FICO!

- bank statement only – Florida-Mortgage-Lenders.com

- Florida -Bank Statement Only Mortgage Lenders

- Bank statement Only Lenders For Self-Employed Homebuyers

- 15%DOWN+BANK STATEMENT FL MORTGAGE LENDERS

- FL Bank Statement Only Mortgage Lenders

STATED INCOME FL MORTGAGE LENDERS PRIMARY HOMES!

STATED INCOME LENDERS for Primary Homes + Same Day Pre Approvals Call 954-667-9110.

15% Down(PRIMARY HOME) Stated Mortgage Lenders

The Stated mortgage lenders allow you do document you income by using bank statements in lieu of traditional full doc loans with tax returns via 4506T to …

Florida stated income mortgage lenders+same day approval

Dec 23, 2016 – FLORIDA STATED INCOME LENDERS PROVIDING FAST & EASY APPROVALS.

stated income florida investment lenders – fha mortgage lenders

Stated Income (No Income Verification). Loan Amounts: $100,000 – $7,000,000. Rates from 8.50% Interest Only. Max LTV 80% (Up to 100% CLTV w/ Rehab …

Stated Income Texas Mortgage Lenders – FHA MORTGAGE LENDERS

… REFINANCE MORTGAGE · BANK STATEMENTS ONLY · STATED INCOME · MANUAL UNDERWRITING … Stated Income Texas Mortgage Lenders …

10% DOWN+STATED INCOME Texas MORTGAGE LENDERS-

“Stated Texas income loans are starting to make a small comeback on the secondary market, but only for Texas Mortgage applicants with good credit scores of …

3.5% Florida FHA Mortgage Lenders Min 580 FICO!!

INVESTOR NO RATIO – No income verification or debt service coverage. …. a home using our statedmortgage program or bank statement only mortgage …

10% Down+Georgia Stated Income Bank Statement Only Mortgage …

Georgia Bank Statement Mortgage Lenders offer a 24-Month Bank Statement Loan Program using bank statements ONLY to qualify with Georgia mortgage …

10% DOWN+STATED INCOME GEORGIA MORTGAGE LENDERS …

10% DOWN+STATED INCOME GEORGIA MORTGAGE LENDERS- … BANK STATEMENT ONLY-GEORGIA STATED MORTGAGE LENDERS! 3. GEORGIA …