NO TAX RETURN BAD CREDIT TEXAS MORTGAGE LENDERS

- GENERAL INFO LOAN TERMS: ● 5 year ARM, 7 year ARM or 30 Year Fixed ● No Pre-payment penalty● Floor = Start rate ● Caps are 2/2/5 (2% initial change cap / 2% annual cap / 5% lifetime cap) ● Index – 1 year libor ● All loans require impound for tax and insurance

- PROPERTY TYPES: ● SFRs, condos, townhouses, 2-4 units (no rural properties < $200,000) ● Property must show “pride of ownership”

- DEBT TO INCOME RATIO: ● 50% max DTI (up to 55% case by case) ● See guidelines for residual income calculations * Requires 0x30 mortgage payment history last 12 months. Full Doc Only

DOWN PAYMENTS: ● All down payment funds must be verified prior to drawing loan documents ● Secondary Financing 80% Max LTV/90% Max CLTV TAX LIENS,

JUDGMENTS: ● All tax liens and judgments must be paid at closing

COLLECTION ACCOUNTS: ● Collections and charge offs need to be paid off except: – Medical Collections – Collection accounts older than 2 years

FIRST-TIME HOME BUYER: ● A , A- and B credit grades. B- grade case by case

BAD CREDIT LENDING CRITERIA: Loan programs for Owner Occ and 2nd homes only ● See InvestorX rate sheets for Non OCC programs

BAD CREDIT TEXAS MORTGAGE LENDERS LOAN AMOUNTS: ● Minimum loan amount $100,000 RESERVES: ● 6 months required above 85% LTV ● 6 months required on 12 Mo Cash Flow Product ● See loans > $1M for additional info

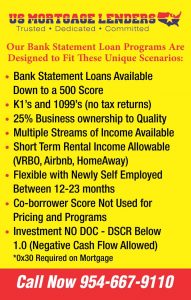

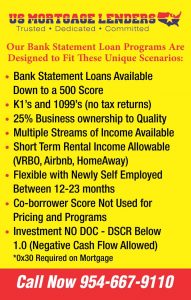

INCOME DOCUMENTATION: ● Full Doc – 2 year (W-2 & paystubs, 1040s, K1’s) ● Full Doc – 1 year (W-2 and Current YTD paystub, K1’s) ● Full Doc – 1 year (One year Tax Return and YTD P&L Self Empl) ● Alt Doc – 12 or 24 months bad credit TEXAS business or personal bank stmts (Self Empl only), Full Doc income with lease agreements, ok (rental income qualified by lease agreements) ● Asset Xpress – 100% of amount needed to amortize loan plus monthly debts for 60 months, max 80% LTV to $1.0M; Max 75% LTV to $1.5M ● Asset Assist – Assets divided by 120 is added to income. $1.5M max loan amount to 75% LTV, Max 80% LTV to $1M ● ALT Doc—3-month Bank Statement (24-month CPA compiled and signed P&L statement supported by 3-months bank stmts) ● ALT Doc—Profit and Loss (P&L) only. 24-month P&L compiled and signed by CPA. CPA must also attest to filing tax returns for borrower for 24-months. ● ALT Doc—VOE only.