BAD CREDIT TEXAS CASHOUT OR BAD CREDIT TEXAS PURCHASE LOANS!

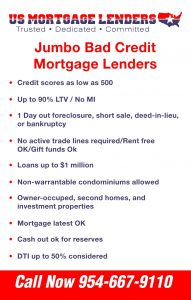

500+ Fico -Texas Bad Credit Jumbo Mortgage Lenders

Texas Bad Credit Jumbo Mortgage Lenders exceed conforming loan limits. A Texas Bad Credit Jumbo Mortgage Lenders provide financing for high-priced or Texas luxury home. If you have a lower debt-to-income ratio, a higher credit score, and a larger down payment, a Texas Bad Credit Jumbo Mortgage Lenders loan may be right for you.

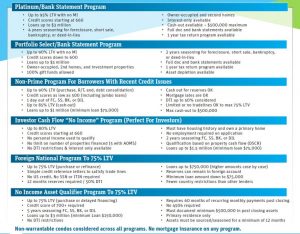

Texas BAD CREDIT MORTGAGE LENDERS PROGRAMS INCLUDE:

- FHA Bad Credit Mortgage Lenders

- VA Bad Credit Texas Mortgage Lenders

- USDA Bad Credit Texas Mortgage Lenders

- Jumbo Bad Credit Texas Mortgage Lenders

- Hard Money Bad Credit Hard Money Lenders

- Condominium Texas Bad Credit Mortgage Lenders

- Town House Texas Bad Credit Mortgage Lenders

- Manufactured Home Texas Bad Credit Mortgage Lenders

- NNon-Warrant-ableCondo Texas Bad Credit Mortgage Lenders

General Texas Conforming Loan Limits for 2017

The general loan limits for 2017 have increased and apply to loans delivered to Fannie Mae in 2017 (even if originated prior to 1/1/2017). This is the first time the base loan limits have increased since 2006. Refer to Lender Letter LL-2016-05 for specific requirements.

The Texas loan limit on conforming loans is $424,100 in Texas but most Texas Bad Credit Jumbo Mortgage Lenders can exceed these limits. Even so, if you’re considering a Texas home in a high-cost area, you may still be able to obtain a conforming fixed-rate mortgage or adjustable-rate mortgage for up to $625,500. FHA loans have limits up to $729,750. Contact a mortgage loan originator to learn more.

Benefits and Considerations For Bad Credit Mortgage Applicants

Higher Purchase Limits

Texas Bad Credit Jumbo Mortgage Lenders mortgages can exceed the conforming loan limit, currently $417,000 in most parts of the United States.

Competitive Rates For Bad Credit

Texas Bad Credit Jumbo Mortgage Lenders loan rates have reached historic lows in recent years, and the interest on loans up to $1 million may be tax-deductible.

Bad Credit Texas Mortgage Lenders

Many Texas Bad Credit Jumbo Mortgage Lenders mortgage lenders may allow you to take out a second mortgage for a combined loan-to-value ratio of up to 90 percent.

Bad Credit Texas Requirements and Qualifications

Bad Credit history – Conventional loans are a good choice for Bad credit mortgage applicants with very bad credit all the way down to a 500 fico scor..

Bad Credit Mortgage Applicants Financial strength – When applying for a Texas Bad Credit Jumbo Mortgage Lenders mortgage, the maximum debt-to-income ratio for Texas Bad Credit Jumbo Mortgage Lenders for loans is 45 percent, and the required reserve amount for Texas Bad Credit Jumbo Mortgage Lenders loan borrowers can be as high as 20 percent of the value of the loan.

Bad Credit Mortgage Applicants Down payment – There is no private mortgage insurance option with a Texas Bad Credit Jumbo Mortgage Lenders mortgage, so the required down payment will be larger – typically 20 percent.

Bad Credit Mortgage Applicants Property appraisal – The property appraisal must support the purchase price for the home and the mortgage the borrower wants.

Texas Bad Credit Jumbo Mortgage Lenders mortgages are a good solution for bad credit mortgage applicants who are looking to buy a higher-priced Texas home.

3.5% BAD CREDIT TEXAS MORTGAGE LENDERS

https://www.fhamortgageprograms.com/3-5-down-texas-bad-credit-mortgage-lenders/

3.5% DOWN BAD CREDIT TEXAS MORTGAGE LENDERS- FHA/VA/PRIVATE Bad credit Texas mortgage lenders! … Texas Mortgage After Foreclosure – Short Sale – Bankruptcy- Foreclosure– Private Portfolio GA Bad Credit Lenders. … https

https://www.fhamortgageprograms.com/3-5-down-bad-credit-texas-mortgage-lenders/

TEXAS MORTGAGE AFTER BANKRUPTCY, FORECLOSURE OR SHORT SALE. Bad Credit Texas Mortgage Lenders After A Bad Credit Event! Have you heard the term “boomerang buyer” is a Texas mortgage applicant who’s been kept out of the housing market due to a prior Texas foreclosure, short sale or bankruptcy You’ve visited this page many times. Last visit: 2/7/18

https://www.fhamortgageprograms.com/texas-fha-mortgage-lenders-bad-credit-no-cre…

https://www.fhamortgageprograms.com/jumbo-texas-bad-credit-mortgage-lenders/JUMBO TEXAS BAD CREDIT MORTGAGE LENDERS. TEXASJUMBO 15-30 YEAR FIXED LOAN PROGRAMS. For your traditionally qualified borrower, we offer dynamo FIXED rates on loans $417 – $3mil. Primary and 2nd homes; SFR, Warrantable Condo, 2-unit; DTI to 45; First time home buyer to $1.2m; Cash Out OK!

https://www.fhamortgageprograms.com › FHA › Florida

BAD CREDIT TEXAS FHA MORTGAGE GUIDELINES Bad Credit Texas Mortgage Lenders general credit policy requirements for underwriting a mortgage involve • considering the type of income the borrower needs in order to qualify to analyze the Texas mortgage applicants liabilities to determine creditworthiness and …

https://www.fhamortgageprograms.com › FHA › Florida

https://www.fhamortgageprograms.com/bad-credit-home-loans/

Bad credit home loans are available for residents in Florida. At FHA mortgage programs.com we go the extra mile to help find secure a bad credit mortgage for our bad credit home loan applicants, regardless of their credit status. If your credit has been ruined as a result of Foreclosure or Bankruptcy, don’t give up on …

https://www.fhamortgageprograms.com/texas-va-mortgage-lenders/

https://www.fhamortgageprograms.com › FHA › Florida

Texas FHA-Mortgage-Lenders.com is dedicated to providing current Texas Home Owners and TexasFirst Time Home Buyers so they can Buy A Home with less than 3.5% down and/or FHA Mortgage Refinance up to 96.5% of the home’s value. Explore FHA Loan Programs including Bad Credit Mortgage Lenders or No ..

bad credit texas FHA mortgage guidelines – FHA mortgage lenders

https://www.fhamortgageprograms.com/bad-credit-texas-fha-mortgage-guidelines/

Bad Credit Texas Mortgage Lenders general credit policy requirements for underwriting a mortgage involve • considering the type of income the borrower needs in order to qualify to analyze the Texasmortgage applicants liabilities to determine creditworthiness and • reviewing ratios, including debt-to-income, and Texas …