BAD CREDIT TEXAS MORTGAGE LENDERS

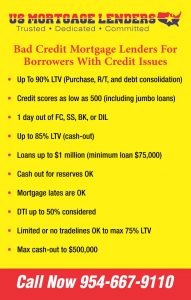

- YES! TEXAS Texas bad credit mortgage WITH COLLECTION ACCOUNTS!

- Texas Bad Credit Texas bad credit mortgage lenders requirements regarding 30,60,90,120 days late payments?

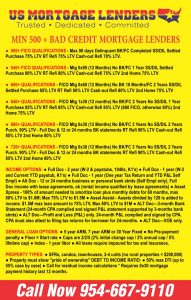

Get Pre Approved after a Bankruptcy or Foreclosure!

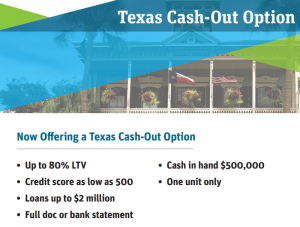

- Bad Credit Bad Credit Texas Cash-Out Refinance Mortgage Lenders

- Texas Cashout Mortgage To Lower Total Expenses

- Texas Cash-Out Refinance Mortgage Lenders

BAD CREDIT TEXAS CASHOUT REFINANCE

With a bad credit cashout refinace you can use the equity built up in your current Bad Credit Texas home to payoff higher interest debt. By borrowing tax deductable low interest mortgage money built up in your Bad Credit Texas home you can payoff higher interest credit card and other higher interest debt to free up monthly income.

WHAT IS A CASHOUT REFINNACE?

A cashout refinance replaces your current mortgage plus gives you cashout up to 80% of your homes value determined by an appriaser. In order to qualify for a cashout refinace you need to have at lease 30% equity in your own or own about 70% of the appriased value. The new loan could be up to 80% of your homes value – closing cost given to you in cash. For example if your home is work 500,000 you could get up to 80% or $400,000 cashout of your home. Depending on your credit and other factors bad credit Bad Credit Texas mortgage lenders may allow you to take up to 50% of your income for housing and other obligations on your credit.

BAD CREDIT TEXAS CASHOUT LAWS AND REQUIRMENTS

Article XVI of the Bad Credit Texas Mortgage Lenders Constitution permits homeowners to borrow against the equity in their primary residences. The Bad Credit Texas Mortgage Lenders Constitution, however, imposes substantial restrictions under which (a)(6) loans may be originated and closed. If any of the requirements or guidelines are not followed, then the lien may be invalid.

Article XVI, Section 50(e) of the Bad Credit Texas Mortgage Lenders Constitution provides that if a refinance loan secured by a Bad Credit Texas homestead property includes the advance of mortgage loan money for more than is necessary to pay off the existing mortgage debt, the lien is not valid unless:

The loan is treated as a Bad Credit Texas Equity Loan

The additional funds are for “reasonable costs necessary to refinance” the debt is paid off, or

The additional funds are for another purpose authorized by the Bad Credit Texas Constitution.

Description / Summary Of Bad Credit Texas Mortgage Lenders Section 50(a)(6) home mortgage loans:

Loans using proceeds to pay off an existing (a)(6) loan.

Loans using proceeds to pay off federal tax debt liens.

Loans using proceeds to pay property tax liens on the property securing the new loan.

Loans with any cash back to the borrowers.

Listed Below Are NOT considered Bad Credit Texas Mortgage Lenders Section 50(a)(6) loans:

Loans using proceeds to pay current taxes due on the property securing the loan.

Loans using proceeds to buy out equity pursuant to a court order or agreement of the parties (usually applies to a divorce settlement).

Bad Credit Texas (a)(6) Mortgage Refinance Restrictions

Bad Credit Texas (a)(6) loans are subject to the following restrictions:

An (a)(6) loan may not be closed sooner than 12 months after the closing of the previous (a)(6) loan.

There can be only one (a)(6) loan secured by the property at one time.

The (a)(6) loan may not be identified as a rate & term refinance.

The (a)(6) loan may not be used to acquire the property or to finance construction.

Loan proceeds used to pay a prepayment penalty assessed on an existing non-(a)(6) loan, and the

prepayment is included in the payoff amount. The new loan must have a new title policy issued without

exception to the financing of the prepayment fee.

o If the title company requires them to be paid, loans that include the payment of HOA dues.

Bad Credit Texas Cashout Refinance Use of Proceeds and Payoff of Debts

The Bad Credit Texas Constitution prohibits a lender from requiring that the proceeds from an (a)(6) loan be used to pay off any

debts to that lender that are not secured by the homestead.

If the payoff of debts to other lenders/creditors is required in order to qualify the borrower, then those

payoffs must be disbursed directly to the creditor by the title company.

Debts that are elected to be for paid off by the borrower, but are not required to be paid off in order to

qualify the borrower, may be disbursed directly to the borrower.

A loan used for consolidating debt must be originated as an (a)(6) loan even if the proceeds at closing are

paid directly to the creditors and the borrower personally receives no cash from the transaction.

The pay off of purchase money loan or a previous no cash-out refinance.

Payment of non-delinquent liens for property taxes on the subject property securing the new loan.

The only cash proceeds the borrower may receive are limited to:

o A refund of a previously paid application fee, OR

o Existing escrow monies in excess of any amount needed to fund any new escrow account.

1-unit SFR, condo or PUD (2-4 unit properties ineligible)

Owner-occupied primary residence

Must be borrower’s Bad Credit Texas homestead

A first mortgage rate & term refinance originated to pay off an existing Bad Credit Texas Equity Loan regardless of whether the

Bad Credit Texas Mortgage Applicant receives any cash-out of the refinance proceeds, is the “Once Bad Credit Texas Equity Loan always a Bad Credit Texas Equity Loan”

rule. Once a Bad Credit Texas Mortgage Applicant obtains a first or second lien Bad Credit Texas Equity Loan, subsequent refinancing of the homestead property

is considered a Bad Credit Texas Equity Loan subject to all the requirements of Section 50(a)(6) of the Bad Credit Texas Constitution if any of

the proceeds are used to pay off the existing Bad Credit Texas Equity Loan even if the Bad Credit Texas Mortgage Applicant does not receive any cash from the

transaction.

Bad Credit Texas Mortgage Lenders will only approve Bad Credit Texas Section 50(a)(6) first lien cash-out refinance loans that are made in accordance with Bad Credit Texas law and the Interpretive Authority adopted by the Bad Credit Texas Finance Commission and Credit

Union Commission.

Loans originated and closed as Bad Credit Texas Section 50(a)(6) loans must strictly adhere to all requirements outlined in this

underwriting guideline to be eligible.

- TEXAS Bad Credit MORTGAGE Lenders

- Pharr Texas Bad Credit Mortgage Lenders Galveston Texas Bad Credit Mortgage Lenders Grapevine Texas Bad Credit Mortgage Lenders DeSoto Texas Bad Credit Mortgage Lenders Euless Texas Bad Credit Mortgage Lenders Spring Texas Bad Credit Mortgage Lenders Port Arthur Texas Bad Credit Mortgage Lenders Pflugerville Texas Bad Credit Mortgage Lenders Rowlett Texas Bad Credit Mortgage Lenders San Marcos Texas Bad Credit Mortgage Lenders Georgetown Texas Bad Credit Mortgage Lenders Mansfield Texas Bad Credit Mortgage Lenders Atascocita Texas Bad Credit Mortgage Lenders Harlingen Texas Bad Credit Mortgage Lenders Sugar Land Texas Bad Credit Mortgage Lenders Cedar Park Texas Bad Credit Mortgage Lenders Victoria Texas Bad Credit Mortgage Lenders Conroe Texas Bad Credit Mortgage Lenders North Richland Hills Bad Credit Mortgage Lenders New Braunfels Texas Bad Credit Mortgage Lenders Flower Mound Texas Bad Credit Mortgage Lenders Temple Texas Bad Credit Mortgage Lenders Missouri City Texas Bad Credit Mortgage Lenders Baytown Texas Bad Credit Mortgage Lenders Bryan Texas Bad Credit Mortgage Lenders Longview Texas Bad Credit Mortgage Lenders Mission Texas Bad Credit Mortgage Lenders Edinburg Texas Bad Credit Mortgage Lenders Allen Texas Bad Credit Mortgage Lenders League City Texas Bad Credit Mortgage Lenders San Angelo Texas Bad Credit Mortgage Lenders Tyler Texas Bad Credit Mortgage Lenders Lewisville Texas Bad Credit Mortgage Lenders Wichita Falls TEXAS Bad Credit MORTGAGE Lenders College Station TEXAS Bad Credit MORTGAGE Lenders Pearland Texas Bad Credit Mortgage Lenders Richardson TEXAS Bad Credit MORTGAGE Lenders The Woodlands TEXAS Bad Credit MORTGAGE Lenders Laredo Texas Bad Credit Mortgage Lenders Plano Texas Bad Credit Mortgage Lenders Corpus Christi Texas Bad Credit Mortgage Lenders Arlington Texas Bad Credit Mortgage Lenders El Paso Texas Bad Credit Mortgage Lenders Fort Worth Texas Bad Credit Mortgage Lenders Round Rock Texas Bad Credit Mortgage Lenders Beaumont Texas Bad Credit Mortgage Lenders Odessa Texas Bad Credit Mortgage Lenders Abilene Texas Bad Credit Mortgage Lenders Denton Texas Bad Credit Mortgage Lenders Waco Texas Bad Credit Mortgage Lenders Midland Texas Bad Credit Mortgage Lenders Carrollton Texas Bad Credit Mortgage Lenders McAllen Texas Bad Credit Mortgage Lenders Killeen Texas Bad Credit Mortgage Lenders Mesquite Texas Bad Credit Mortgage Lenders Pasadena Texas Bad Credit Mortgage Lenders Frisco Texas Bad Credit Mortgage Lenders McKinney Texas Bad Credit Mortgage Lenders Brownsville Texas Bad Credit Mortgage Lenders Grand Prairie Texas Bad Credit Mortgage Lenders Amarillo Texas Bad Credit Mortgage Lenders Irving Texas Bad Credit Mortgage Lenders Garland Texas Bad Credit Mortgage Lenders Lubbock Texas Bad Credit Mortgage Lenders San Antonio Texas Bad Credit Mortgage Lenders Houston Texas Bad Credit Mortgage Lenders Austin Texas Bad Credit Mortgage Lenders Dallas Texas Bad Credit Mortgage Lenders