Texas Condo, Co-op, Non-Warrantable Condo Lenders

Texas Condo, Co-op, Non-Warrantable Condo Lenders

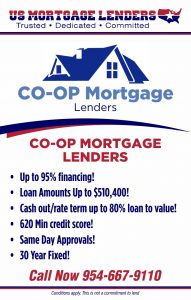

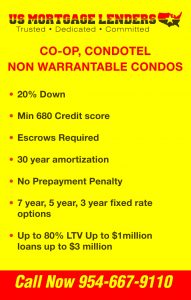

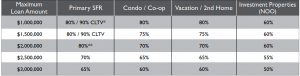

TEXAS CO-OP MORTGAGE LENDERS LOAN TO VALUE

TEXAS CO-OP MORTGAGE LENDERS LOAN TO VALUE

TEXAS CO-OP MORTGAGE LENDERS TERMS

The ARM is a 1st mortgage adjustable rate loan with principal and interest payments amortized over 30 years.

- 3/1 ARM: Rate is fixed for 3 years.

- 5/1 ARM: Rate is fixed for 5 years.

- 7/1 ARM: Rate is fixed for 7 years.

- 30 Year fixed for 30 years.

TEXAS CO-OP MINIMUM & MAX LOAN AMOUNTS

• $100,000 minimum loan amount. Exceptions considered on a case-by-case.

• Co0OP Loan amount exceptions over $4,000,000 available.

TEXAS CO-OP MORTGAGE LENDERS CREDIT REQUIREMENTS

• 680 middle score required with some exceptions allowed for lack of credit or unestablished credit.

• For co-co-op mortgage applicants and co-mortgagers, the lowest mid-score is used for pricing and qualification.

• Meeting the minimum credit score requirement does not automatically constitute a credit approval. A pattern of

adverse credit or overextended credit may disqualify co-op mortgage applicant from financing, even if the minimum credit score is met.

• Credit report is used for Pre-Approval and co-op mortgage lenders will also pull credit before issuing a conditional

approval. Mid-score from co-op mortgage lenders credit pull is used for pricing and qualification.

No Credit or Limited Credit

• No credit or limited credit profiles are allowed on a case-by-case basis for U.S. citizens.

• No U.S. credit or credit score is required for the Work Visa/Expatriate/Immigrant Program or Foreign National Program

TEXAS CO-OP MORTGAGE LENDERS OPTIONS INCLUDE:

- Primary TEXAS Co-op Mortgage Lenders

- Second Home TEXAS Co-op Mortgage Lenders

- Investments TEXAS Co-op Mortgage Lenders

- Cash Out TEXAS Co-op Refinancing

- Second TEXAS Co-op Home Financing

- Jumbo TEXAS Co-op Loans

- Low TEXAS Co-op Closing Costs

- Up to 80 Percent TEXAS Co-op Mortgage Loans

TEXAS CO-OP MORTGAGE MAXIMUM DEBT TO INCOME

Maximum TEXAS CO-op Mortgage Lenders Debt To Income Ratio

• 43% maximum back-end ratio.

TEXAS CO-OP MORTGAGE LENDERS APPROVAL PROCESS

2. PRINT OUT CONDO QUESTIONNAIRE FOR ASSOCIATION TO FILL OUT COMPLETE. the questionnaire must be 100% complete for Approval Commitment. No blanks or questions answered “n/a”

or “unknown,” and the questionnaire must pass underwriter review.

ELIGIBLE TEXAS CO-OP PROPERTY TYPES & OCCUPANCY

TEXAS Co-op Occupancy Permitted

• Primary TEXAS Co-op Residence

• Second TEXAS Co-op Home (minimal rental income allowed)

• Investment TEXAS Co-op Property (non-owner TEXAS Co-op occupied) permitted at maximum TEXAS Co-op loan of 60% LTV

ELIGIBLE TEXAS CO-OP MORTGAGE REQUIREMENTS

• Minimum Down Payment 20% For TEXAS Co-op Mortgage Lenders

• Title Insurance for TEXAS Co-ops title policy issued through a title company or closing attorney must be issued on TEXAS Co-op certificate

• Leaseholds TEXAS Co-op allowed on a case-by-case basis

BAD CREDIT TEXAS CO-OP MORTGAGE LENDERS CREDIT REQUIREMENTS

• Late payments on any mortgage, installment or revolving account of 2×30, 1×60 or more will typically disqualify a

borrower from financing. Exceptions will be reviewed on a case-by-case basis at a lower LTV.

• A pattern of adverse credit or overextended credit may disqualify borrower from financing, even if minimum credit score

is met. Borrowers with 3x monthly income amount in unsecured consumer debt are generally disqualified.

TEXAS CO-OP MORTGAGE LENDERS REQUIREMENTS AFTER FORECLOSURE, BANKRUPTCY, SHORT SALE

• (4)Four-year seasoning from BK discharge date or sale of property

• Maximum 60% LTV or 40% downpayment

• No derogatory credit allowed since the bad credit event

• Strong extenuating circumstance and signed letter of explanation from co-op mortgage applicant detailing event required.

NOT ALLOWABLE FOR TEXAS CO-OP MORTGAGE LENDERS

– Structural TEXAS Co-op deficiencies and certain pending litigation (please contact your AE if litigation is not related to a structural issue)

– Incomplete TEXAS Co-op construction of the subject phase

APPROVED OR ALLOWED TEXAS CO-OP MORTGAGE LENDERS CASE BY CASE:

– Low TEXAS Co-op HOA budget reserves

– HOA TEXAS Co-op delinquencies exceeding 15%

• TEXAS Co-op mortgage lenders Questionnaire must be 100% complete for Approval Commitment. No blanks or questions answered “n/a” or “unknown,” and the TEXAS Co-op questionnaire must pass underwriter review.

• TEXAS Co-ops mortgage lenders price TEXAS Co-ops the same as Non-Warrantable Condos, regardless of loan size or TEXAS Co-op questionnaire findings.

• TEXAS Co-op must pust have a full kitchen and at least one separate bedroom. Minimum TEXAS Co-op size 500 square feet generally required. Efficiency TEXAS Co-ops or studio units are not permitted.

• Coinsurance TEXAS Co-op is considered case-by-case if no agreed amount endorsement is available.

SELF EMPLOYED TEXAS CO-OP MORTGAGE LENDERS

Self-Employed co-op mortgage Income calculations

• Borrower should be self-employed in the U.S. for a minimum of 2 years (max 80% LTV).

• 2-years business & personal tax returns required, plus year-to-date Profit & Loss statement.

• Business tax returns required for all businesses in which the borrower has 25% ownership or more. On occasion

business tax returns are needed if the borrower is has less than 25% ownership.

• Fannie Mae cash flow analysis form can be used.

• NOL Carryover Loss: Treated case-by-case when truly a one-time occurrence (i.e. real estate loss, lawsuit settlement or some other form of a truly one-time occurrence). Detailed CPA letter addressing the one-time occurrence is required.

• Less than two years self-employment is considered on a case-by-case basis with a reduced LTV.

REQUIRED BY TEXAS CO-OP MORTGAGE LENDERS

• 2-months bank statements for monthly asset accounts, and most recent statement for quarterly asset accounts

(VOD not permitted).

• 6 months PITI for all TEXAS co-op properties owned including subject.

• At least 3 months of the subject property’s reserves must be liquid non-retirement.

TEXAS CO-OP MORTGAGE LENDERS CASE BY CASE MORTGAGE APPROVALS

• TEXAS Co-op Current reserve balance meets or exceeds 2 months of the subject property’s TEXAS Co-op HOA dues in reserves multiplied by all TEXAS Co-op units in the TEXAS Co-op project or 10% or more reserve allocation designated in the most recent TEXAS Co-op budget.

SECOND HOME TEXAS CO-OP MORTGAGE LENDERS

• TEXAS Co-op Mortgage Lenders will typically define a property as a second TEXAS Co-op home if it is (1) located in a vacation or resort area 30 or more miles from the primary TEXAS Co-op residence or (2) used a TEXAS Co-op college housing for enrolled dependent within 5 miles of campus)

• Short-term TEXAS Co-op rental income is allowed on second TEXAS Co-op homes and generally does not constitute a TEXAS Co-op investment property designation. TEXAS Co-op Rental income cannot be used to qualify. An evaluation of the 1040 Schedule E is required.

TEXAS CO-OP MORTGAGE FOR INVESTMENT PROPERTY

• Property titled in LLC allowed

• Maximum TEXAS Co-op 60% LTV for investor TEXAS Co-op mortgage lenders.

• Gross rental income is calculated by using a 12 month average of the net Schedule E income (Line 21) plus depreciation, mortgage interest paid to banks, taxes and insurance, and TEXAS Co-op HOA dues.

• Rental income not appearing on Schedule E may be considered case-by-case with 3 months canceled checks and a

current lease agreement. Use 75% of gross rent as gross rental income.

• Immediate TEXAS Co-op rental income on the purchase of an investment property is allowed using 75% of the monthly rent schedule as documented by Form 1007 or 1025.

• Cash-out is allowed up to $3,000,000 with no seasoning required.

WHAT IS A TEXAS CO-OP AND HOW DO I GET A TEXAS MORTGAGE?

A TEXAS Co-op or cooperative apartment is an individual living unit within a TEXAS Co-op building or development where a buyer purchases shares (equal to the value of the unit) in a TEXAS Co-op corporation that holds title to a building Coops are predominantly located. Normally a TEXAS Co-op sponsor will buy the building (takes out the underlying TEXAS Co-op mortgage) and then will sell off the shares. Therefore, when buying a coop, you are actually buying TEXAS Co-op shares in a corporation, not buying real property.

HOW TO TEXAS CO-OP BUILDINGS GET PRE QUALIFIED BY TEXAS MORTGAGE LENDERS?

To start with TEXAS Co-op lender will look at the following factors to see if a particular TEXAS Co-op building corresponds with their guidelines: the TEXAS Co-op property’s resale value, investor concentration, and TEXAS Co-op owner occupancy. Based on the previous example, if there are 20 units, five sponsor rentals and 15 sold units (with 12 owner-occupied units and 3 units being rented by the TEXAS Co-op owners), the following ratios and guideline percentages result:

HOW IS A TEXAS CO OP DIFFERENT FROM A HOUSE OR CONDO?

When you get a mortgage to purchase a house or condo you get the deed. But not with a TEXAS Co-op, individual units do not have individual deeds. A TEXAS Co-op mortgage is actually a “share-loan” or a loan that purchases a share within in the TEXAS Co-op. The difference makes securing a loan for a TEXAS Co-op more complicated them getting a traditional mortgage and fewer mortgage lenders offer share loans.

TEXAS COOP BOARDS AND APPROVAL RULES

To buy into a TEXAS Co-op, you must be approved by the TEXAS Co-op board. The approval process is often extensive and may require interviews and character references, in addition to your employment, financial, and credit history. TEXAS Co-op boards can refuse a prospective buyer for any reason, so long as it doesn’t run afoul of anti-discrimination policies. What you can do WITH your TEXAS Co-op unit. As a TEXAS Co-op shareholder, you don’t have the right of alienation where basically, you can’t sell your TEXAS Co-op share (or rent your TEXAS Co-op unit) without the permission of the TEXAS Co-op board. Some TEXAS Co-op associations have the right of first refusal, meaning they have the option to buy the property before you offer your TEXAS Co-op to outside buyers. TEXAS Co-op boards, though, can simply deny a sale without matching the sale price.

HOW TEXAS COOP OWNERSHIP DIFFERS FROM CONDO OWNERSHIP

When you purchase a condominium you are purchasing a specific unit the surface and the interior walls of the unit in the space the condo contains. With a Co-op, you are purchasing a share in a corporation, which then entitles you to a unit. This share is considered personal property rather than real estate.

Co-Op Resources

- Buying into a Housing Cooperative

- Lessons for Success

- Resident Retention

- Starting a new Cooperative

- Benefits to Continuing as a Cooperative

- Pros & Cons to Owning a Cooperative

- What is a TEXAS housing cooperative?

- What do I actually own?

- What does the share or membership purchase price involve?

- Do I pay real estate taxes?

- Are cooperatives allowed to discriminate?

- What do cooperatives look like?

- How to find a cooperative?

- What questions should I ask before buying into a cooperative?

- Economic Advantages

- Social Advantages

- Physical Benefits

- Standard Cooperative Practices

- What is a share loan?

- How do I accumulate equity?

- Market-rate housing cooperatives

- Limited-equity housing cooperatives

- Leasing cooperatives (or zero-equity)

- What are the monthly charges for?