NO TAX RETURN TEXAS MORTGAGE LENDERS

-

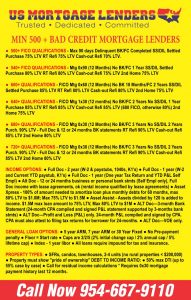

MIN 500 Credit Score~!

-

12 or 24 Months Texas Business or Texas Personal Bank Statements

-

Texas Bank Statement Only (Personal or Business)

-

No Tax Returns No Tax Transcripts Required

-

Florida Jumbo Bank Statement Loans Up To $5 million

-

(Min Bank Statement Only Florida Loan Amount $100,000)

-

1099 + W2 Income Or Mixed Deposits OK!

-

DTI up to 55% Considered!

-

Owner-Occupied, 2nd Homes, Investment Properties

-

Foreclosure, Short-Sale, BK, DIL – OK!!

-

Non-Warrantable Condos – OK!

-

5/1 ARM 7/1 ARM Or 30-Year Fixed

-

or Owner-Occ And 2nd Homes + Investment!

-

SFRs, Townhomes, Condos, 2-4 Units

-

Seller Concessions To 6% (2% For Investment)

-

Mix Of Both Personal And Business Florida Bank Statement Deposits OK!

SELF-EMPLOYED 12 or 24 MONTHS BANK STATEMENTS DOCUMENTATION The Texas Self Employed 24 Months Bank Statements program is available to Texas Self Employed Texas Self Employed mortgage applicants only and allows the use of 24 months of bank statements to document self-employment income. Income documented through the Texas Self-Employed Bank Statement method may be combined with other income sources that are documented as Full Doc but not associated with self-employment, such as a spouse employed as a wage earner. When wage income is combined with Texas Self Employed 12/24 Months Bank Statements, a tax return is not required for the full income documentation, as this would invalidate the Texas bank statements. The 4506T is still required, however, box 8 should be checked to obtain atran script of W-2 earnings. Self-Employed Texas Bank Statements loans will be considered Non-QM.Texas Self Employed Mortgage Lenders Guidelines: Self Employed Bank statement mortgage lenders have loosed guidelines for Texas Self Employed Texas mortgage applicants. For example, you might only have to supply one year’s worth of income tax documents as proof of your income, if your application qualifies for the automated underwriting process. Also, a new income calculation is being used by lenders for business owners who have no or little history of distributions. New loan guidelines are also more friendly for those who “moonlight.” Individuals with Texas Self Employed part-time gigs don’t always need to document the income if they qualify with only using their regular job.Personal Accounts Account reflecting personal income and expenses. Verify the existence of the business, within 60-days of the note date, to ensure the business is active with the following; a letter from either the Texas businesses tax professional certifying 2 years of self-employment in same business, or regulatory agency or licensing Bureau; Verify that the borrower owns a minimum of 25% of the business; Most recent 12 or 24 months of PERSONAL Texas bank statements; Most recent 2 months of Texas BUSINESS bank statements.Texas Business Accounts Account in the name of the business reflecting only business in command expenses.Verify the existence of the Texas business, within 60-days of the note date, to ensure the business is active with the following; a letter from either the businesses Texas tax professional certifying 2 years of self-employment in same business, or regulatory agency or licensing Bureau;Verify that the borrower is 100% owner of the business (Split ownership between a husband and wife permitted as long as both are on the note. If not on the note, 50%of the income may be used); 12 and 24 Month Income/Expense Documentation Options:o 12 or 24 Month CPA compiled P&L Statement (P&L) prepared/complied and signed by a CPA (Proof of CPA current state license required) matching the time-period covered by the bank statements, and A minimum 3-months of business bank statements covering the most recent 3-month period.o Business Expense Statement Letter: (all loans over $3 Million require the following in addition to other standard documentation)An expense statement specifying business expenses as a percent of the gross annual sales/revenue prepared and signed by either a CPA or tax preparer; and 12 or 24-months of business bank statements covering the most recent time period and matching the time period covered by the P&L.o 12 or 24 Month P&L Statement ((all loans over $3 Million require the following in addition to other standard documentation)O P&L compiled by either a CPA/accountant or licensed taxpreparer; and12 or 24-months of business bank statements covering the most recent time-period and matching the time-period covered by theP&L.o 12 or 24 Month borrower prepared P&L statement: (all loans under $3 Million require the following)P&L prepared and signed by the borrower; andA business narrative provided by the borrower which includes detail regarding the size and operating profile of the business addressing; location/rent, number of employees/contractors,The Mortgage Approval Process For Applicants Who Are Self Employed When you are refinancing or buying a Texas home, there will be a series of specific steps that you will need to go through in order to qualify using bank statements only for income..First of all, you will need to apply for a loan. You can do that by telephone, online, or in-person. Usually, the loan processor or officer will verbally take your information and submit it to an automated underwriting system (AUS). Normally, you won’t need to fill a lot of forms out. However, you will need to document your income, any investment/retirement/savings balances, and all of your debt. Lenders will run a credit check and want to know about your employment history.Underwriting Texas Self Employed Mortgage Applicants Who Are Self Employed Based on the information that you provide, a response will be generated by the underwriting system within minutes, either declining, approval or referring your loan to be underwritten by a human. The human underwriter will then take over. If you are approved by the AUS, your documents will be checked by the underwriter to ensure they match the information that is on your application. For example, if you stated that you earn $6,000 per month, then your tax returns or W-2s should match that number. Also, your bank statements should match the amount that you say you own. If the system declines your loan or cannot make a decision, then a human will look at your application to see if you qualify under their manual underwriting guidelines.Only Taxable Income Is Considered By Almost all Texas Mortgage Lenders What often trips up a Texas Self Employed mortgage applicant is they may state they earn $200,000 per year. However, their taxable income may only show $40,000 per year. A somewhat complicated form is used by underwriters to come up with what is called “qualifying” income for Texas Self Employed mortgage applicants who are self-employed. They start off with your taxable income and then certain deductions such as depreciation are added back in since they are not actual expenses coming directly out of your bank account. However, they may also subtract “windfall” or “extraordinary” income. If an income source doesn’t seem to be ongoing and stable, then usually it cannot be used to qualify to get approved for a home loan.Other Supporting Documents Lenders will also review your assets, to ensure the down payment is coming from a source that is acceptable. They don’t want you cleaning your business account out for your down payment, for example, since that could jeopardize your livelihood.They also want to ensure that you don’t have any undisclosed loan. So, for example, if an unusually large deposit was made to your bank account within the past 60 days, the underwriter might ask you to prove the money’s source. You might need to provide additional documentation as well, at the underwriter’s discretion, such as a statement fro your accountant or a business license.Credit Approval After you have been given the green light by the human underwriting, you will have been approved for credit, meaning you, the borrower has met the lender’s guidelines and will be able to close on a property as long as it complies with the requirements of your lender. However, the underwriting process will vary from one applicant to the next and from one loan to the next as well. Underwriters may require various documents for each mortgage borrower who is self-employed.How long do you need to have been self employed in order to obtain a mortgage?In order to obtain a mortgage, you might not need to show a self employment history of 24 months. For example, Fannie Mae states that you might qualify with self employment of 12 months if you have prior experience in your field, and you have income that is much or more of what you earned in the field prior to becoming self-employed.Mortgages For Texas Self Employed Texas Self Employed mortgage applicants Who Are Self Employed Fannie Mae has allowed for a looser set of guidelines to be used for the Texas self employed Texas Self Employed mortgage applicants. There are three areas that are encompassed in the policy updates:

SELF-EMPLOYED 12 or 24 MONTHS BANK STATEMENTS DOCUMENTATION The Texas Self Employed 24 Months Bank Statements program is available to Texas Self Employed Texas Self Employed mortgage applicants only and allows the use of 24 months of bank statements to document self-employment income. Income documented through the Texas Self-Employed Bank Statement method may be combined with other income sources that are documented as Full Doc but not associated with self-employment, such as a spouse employed as a wage earner. When wage income is combined with Texas Self Employed 12/24 Months Bank Statements, a tax return is not required for the full income documentation, as this would invalidate the Texas bank statements. The 4506T is still required, however, box 8 should be checked to obtain atran script of W-2 earnings. Self-Employed Texas Bank Statements loans will be considered Non-QM.Texas Self Employed Mortgage Lenders Guidelines: Self Employed Bank statement mortgage lenders have loosed guidelines for Texas Self Employed Texas mortgage applicants. For example, you might only have to supply one year’s worth of income tax documents as proof of your income, if your application qualifies for the automated underwriting process. Also, a new income calculation is being used by lenders for business owners who have no or little history of distributions. New loan guidelines are also more friendly for those who “moonlight.” Individuals with Texas Self Employed part-time gigs don’t always need to document the income if they qualify with only using their regular job.Personal Accounts Account reflecting personal income and expenses. Verify the existence of the business, within 60-days of the note date, to ensure the business is active with the following; a letter from either the Texas businesses tax professional certifying 2 years of self-employment in same business, or regulatory agency or licensing Bureau; Verify that the borrower owns a minimum of 25% of the business; Most recent 12 or 24 months of PERSONAL Texas bank statements; Most recent 2 months of Texas BUSINESS bank statements.Texas Business Accounts Account in the name of the business reflecting only business in command expenses.Verify the existence of the Texas business, within 60-days of the note date, to ensure the business is active with the following; a letter from either the businesses Texas tax professional certifying 2 years of self-employment in same business, or regulatory agency or licensing Bureau;Verify that the borrower is 100% owner of the business (Split ownership between a husband and wife permitted as long as both are on the note. If not on the note, 50%of the income may be used); 12 and 24 Month Income/Expense Documentation Options:o 12 or 24 Month CPA compiled P&L Statement (P&L) prepared/complied and signed by a CPA (Proof of CPA current state license required) matching the time-period covered by the bank statements, and A minimum 3-months of business bank statements covering the most recent 3-month period.o Business Expense Statement Letter: (all loans over $3 Million require the following in addition to other standard documentation)An expense statement specifying business expenses as a percent of the gross annual sales/revenue prepared and signed by either a CPA or tax preparer; and 12 or 24-months of business bank statements covering the most recent time period and matching the time period covered by the P&L.o 12 or 24 Month P&L Statement ((all loans over $3 Million require the following in addition to other standard documentation)O P&L compiled by either a CPA/accountant or licensed taxpreparer; and12 or 24-months of business bank statements covering the most recent time-period and matching the time-period covered by theP&L.o 12 or 24 Month borrower prepared P&L statement: (all loans under $3 Million require the following)P&L prepared and signed by the borrower; andA business narrative provided by the borrower which includes detail regarding the size and operating profile of the business addressing; location/rent, number of employees/contractors,The Mortgage Approval Process For Applicants Who Are Self Employed When you are refinancing or buying a Texas home, there will be a series of specific steps that you will need to go through in order to qualify using bank statements only for income..First of all, you will need to apply for a loan. You can do that by telephone, online, or in-person. Usually, the loan processor or officer will verbally take your information and submit it to an automated underwriting system (AUS). Normally, you won’t need to fill a lot of forms out. However, you will need to document your income, any investment/retirement/savings balances, and all of your debt. Lenders will run a credit check and want to know about your employment history.Underwriting Texas Self Employed Mortgage Applicants Who Are Self Employed Based on the information that you provide, a response will be generated by the underwriting system within minutes, either declining, approval or referring your loan to be underwritten by a human. The human underwriter will then take over. If you are approved by the AUS, your documents will be checked by the underwriter to ensure they match the information that is on your application. For example, if you stated that you earn $6,000 per month, then your tax returns or W-2s should match that number. Also, your bank statements should match the amount that you say you own. If the system declines your loan or cannot make a decision, then a human will look at your application to see if you qualify under their manual underwriting guidelines.Only Taxable Income Is Considered By Almost all Texas Mortgage Lenders What often trips up a Texas Self Employed mortgage applicant is they may state they earn $200,000 per year. However, their taxable income may only show $40,000 per year. A somewhat complicated form is used by underwriters to come up with what is called “qualifying” income for Texas Self Employed mortgage applicants who are self-employed. They start off with your taxable income and then certain deductions such as depreciation are added back in since they are not actual expenses coming directly out of your bank account. However, they may also subtract “windfall” or “extraordinary” income. If an income source doesn’t seem to be ongoing and stable, then usually it cannot be used to qualify to get approved for a home loan.Other Supporting Documents Lenders will also review your assets, to ensure the down payment is coming from a source that is acceptable. They don’t want you cleaning your business account out for your down payment, for example, since that could jeopardize your livelihood.They also want to ensure that you don’t have any undisclosed loan. So, for example, if an unusually large deposit was made to your bank account within the past 60 days, the underwriter might ask you to prove the money’s source. You might need to provide additional documentation as well, at the underwriter’s discretion, such as a statement fro your accountant or a business license.Credit Approval After you have been given the green light by the human underwriting, you will have been approved for credit, meaning you, the borrower has met the lender’s guidelines and will be able to close on a property as long as it complies with the requirements of your lender. However, the underwriting process will vary from one applicant to the next and from one loan to the next as well. Underwriters may require various documents for each mortgage borrower who is self-employed.How long do you need to have been self employed in order to obtain a mortgage?In order to obtain a mortgage, you might not need to show a self employment history of 24 months. For example, Fannie Mae states that you might qualify with self employment of 12 months if you have prior experience in your field, and you have income that is much or more of what you earned in the field prior to becoming self-employed.Mortgages For Texas Self Employed Texas Self Employed mortgage applicants Who Are Self Employed Fannie Mae has allowed for a looser set of guidelines to be used for the Texas self employed Texas Self Employed mortgage applicants. There are three areas that are encompassed in the policy updates:

-

Texas Self employed mortgage applicants without a history of “taking paychecks” (i.e. distributions from the business are non-existent or irregular)

-

Texas Self employed mortgage applicants who do not have federal tax returns for two years for supporting their business

-

Texas Self employed mortgage applicants who have a second, self employment job do not need to document this income if it is not needed to qualify for a mortgage

Texas Self employed mortgage applicants Income Proof

For self employed Texas Self Employed mortgage applicants who have a track record of paying themselves, the June 2016 mortgage guidelines state that the borrower does not need to prove access to their business income any longer. However, the applicant might still have to show that the business earns enough in order to support the withdrawals of income.

Texas Mortgage With Self Employed “Side” Income

This third provision might be the one that self employed mortgage Texas Self Employed mortgage applicants welcome the most -especially those who don’t have to rely on their “side business” in order to support their household or home. Under the new Fannie Mae rules, Texas Self Employed mortgage applicants who qualify for a mortgage using the income from their “regular job” will not need to prove what they earn on the side from their own business. That totally makes sense; why would you need to prove income that you don’t need in order to qualify for a loan? The provision also applies to Texas Self Employed mortgage applicants who are living off off dividends, pension payments, social security income, or retirement income also.

Not that those rules apply to conforming home loans (Freddie Mac and Fannie Mae). Other loans might have different guidelines.

Self Employed Co-Texas Self Employed mortgage applicants

In a similar fashion, if you qualify to get a loan with your own income, and you have a self employed co-borrower, that business might be ignored by lenders in underwriting. Why would you want that business to be ignored? Because many start-ups and small ventures don’t show income on their tax returns. On paper at least, they generate losses. Although business write-offs are good to help reduce taxes, they can wreak havoc on your qualifying (taxable) income whenever you are applying for a home mortgage.

Texas Self Employed Mortgage Applicants

BORROWERS MUST BE SELF-EMPLOYED TO QUALIFY FOR THIS PROGRAM.

DOCUMENT REQUIREMENTS

(1) 12 or 24 months Personal or 24 months Business Bank statements

Borrowers who own more than 3 businesses must use personal bank statements option

Bank statements must be most recent available at time of application and must be consecutive

(2) Profit & Loss Statement

If submitting personal bank statements, a P&L prepared by the borrower covering no less than 12 or 24 months is required

The P&L must be signed by the borrower

If submitting business bank statements, a P&L prepared by the borrower covering no less than 24 months is required

Borrower is required to provide separate P&Ls for each business being used in qualifying.

The P&L should generally cover the same calendar months as the bank statements provided.

(3) Validation of a minimum of 2 years existence of the business from one of the following: Business License, Letter from Tax Preparer, Secretary of State Filing or

equivalent

Self Employed/Wage Earner Combination - Joint borrowers with 1 wage earner and 1 self-employed business owner can verify income separately, with the self-

employed borrower utilizing bank statements and the wage earner providing pay stubs/W-2s. The wage earner 4506T should include W-2 transcripts only.

PROFIT & LOSS ANALYSIS

• Net Income from the P&L will be used as Qualifying Income for both personal and business bank statements.

• The P&L used for qualifying must be signed by the borrower.

• Declining Income requires an LOE

• Any amounts on the P&L representing salary/wages paid to the borrower/business owner can be added back and considered in the net income analysis.

• Expense line items that can be added back to the business net income include depreciation, depletion, amortization, casualty losses, and other losses or

expenses that are not consistent and recurring.

• Borrowers utilizing business bank statements that own > 50% but < 100% of a business will be qualified at the P&L/AES net income multiplied by their ownership

percentage.

• The P&L expense ratio, Gross Income minus Net Income, divided by Gross Income, should be reasonable for the profession.

Example: A home-based sole practitioner therapist/consultant can be expected to have a low expense ratio, while a retail business that has a full staff of

employees and relies heavily on inventory to generate income will have a high expense ratio.

• If the file does not contain a CPA prepared P&L, steps must be taken by the underwriter to evaluate the reasonableness of the expenses listed by the borrower.

• This requires the borrower to provide a business narrative which includes detail related to the size/scope and operating profile of the business, including the

following: o Description of Business/Business Profile o Location & Associated Rent o Number of Employees / Contractors o Estimated Cost of Goods Sold (Does

business involve sale of goods or just services?) o Materials/Trucks/Equipment o Commercial or Retail client base? o Business Analysis

• Expenses listed on a borrower prepared P&L should generally relate to the information provided below.

Alternative Options For Self Employed Applicants

Mortgage loans for Texas Self Employed applicants have earned the reputation for being hard to obtain ever since the housing downturn. That is due to the fact that numerous Texas Self Employed Texas Self Employed mortgage applicants do not show a sufficient amount of income if the lender defines “income” as being the bottom line of the tax return. Also, the old “no-income verification” and “stated income” loans that were used in the past by these Texas Self Employed mortgage applicants have disappeared. When the taxes are being prepared for the Texas Self Employed borrower, they deduct as many expenses as are legally possible. This is a reasonable thing to do since they pay self-employment taxes along with “regular” income tax. However, there are alternative programs that are available where all of the business cash flow that actually comes in is allowed to be counted as income. There are often referred to as “bank statement” programs.

Under those guidelines, you will provide 24 months of personal and/or business bank statements. The lender will analyze the amount of money that is going into your bank account every month, take an average, and then use this amount (or a formula that is based on this amount) for determining the qualifying income. One thing to note is those programs normally have higher mortgage interest rates.

Texas Mortgage Lenders

A Texas mortgage loan is a potential option that a Texas Self Employed borrower could use. It might be easier to qualify for a Texas mortgage loan compared to a mortgage. If you are wanting to Texas mortgage Texas mortgage refinance your home in order to cash-out, then the easier route might be a personal loan. If you were looking to purchase, a Texas mortgage loan may be a stretch, unless you are buying a sub-$300,000 property, since that tends to be the maximum on those Texas mortgage.

Either way, if your business needs an infusion of cash or some quick money (whether you are trying to get a mortgage or not), then a personal loan may be the right jolt that your company needs to get to the next level.

Self Employed Texas Mortgage Lenders Documentation

Gather the following documents for lenders if you are self employed:

-

Texas Business license

-

2 Two years of business tax returns including schedules 1120S, 1120, and K-1

-

2 Two years of personal tax returns

-

Year-to-date profit and loss statement

-

Signed letter from your CPA stating you are in business for at least 2 years and withdraw from your business account will not negatively affect your business.

Tax mortgage loan professionals are accustomed to these types of requests for mortgages. Your CPA might be able to email all of the documentation that is required on the same day.

One Year of Texas Income Tax Returns

A Texas self employed Texas mortgage applicant might qualify with only one year of income tax returns. The returns must show 12 months at least of self employment income.

The debt-to-income ratio of the Texas mortgage applicant must also meet the guidelines of the lender but for exceptionally qualified Texas mortgage applicant might go up to 50 percent.

What are the current Texas mortgage rates?

Self-employed Texas Self Employed mortgage applicants can get approved for a mortgage more than at any time during this decade. Mortgage rates are low right now, so it is a great time to consider the options that are available to you. Please note that if you do not qualify under the standard guidelines, you might be able to buy the home you want under alternative programs.

SELF-EMPLOYED 12 or 24 MONTHS BANK STATEMENTS DOCUMENTATION The Texas Self Employed 24 Months Bank Statements program is available to Texas Self Employed Texas Self Employed mortgage applicants only and allows the use of 24 months of bank statements to document self-employment income. Income documented through the Texas Self-Employed Bank Statement method may be combined with other income sources that are documented as Full Doc but not associated with self-employment, such as a spouse employed as a wage earner. When wage income is combined with Texas Self Employed 12/24 Months Bank Statements, a tax return is not required for the full income documentation, as this would invalidate the Texas bank statements. The 4506T is still required, however, box 8 should be checked to obtain atran script of W-2 earnings. Self-Employed Texas Bank Statements loans will be considered Non-QM.Texas Self Employed Mortgage Lenders Guidelines: Self Employed Bank statement mortgage lenders have loosed guidelines for Texas Self Employed Texas mortgage applicants. For example, you might only have to supply one year’s worth of income tax documents as proof of your income, if your application qualifies for the automated underwriting process. Also, a new income calculation is being used by lenders for business owners who have no or little history of distributions. New loan guidelines are also more friendly for those who “moonlight.” Individuals with Texas Self Employed part-time gigs don’t always need to document the income if they qualify with only using their regular job.Personal Accounts Account reflecting personal income and expenses. Verify the existence of the business, within 60-days of the note date, to ensure the business is active with the following; a letter from either the Texas businesses tax professional certifying 2 years of self-employment in same business, or regulatory agency or licensing Bureau; Verify that the borrower owns a minimum of 25% of the business; Most recent 12 or 24 months of PERSONAL Texas bank statements; Most recent 2 months of Texas BUSINESS bank statements.Texas Business Accounts Account in the name of the business reflecting only business in command expenses.Verify the existence of the Texas business, within 60-days of the note date, to ensure the business is active with the following; a letter from either the businesses Texas tax professional certifying 2 years of self-employment in same business, or regulatory agency or licensing Bureau;Verify that the borrower is 100% owner of the business (Split ownership between a husband and wife permitted as long as both are on the note. If not on the note, 50%of the income may be used); 12 and 24 Month Income/Expense Documentation Options:o 12 or 24 Month CPA compiled P&L Statement (P&L) prepared/complied and signed by a CPA (Proof of CPA current state license required) matching the time-period covered by the bank statements, and A minimum 3-months of business bank statements covering the most recent 3-month period.o Business Expense Statement Letter: (all loans over $3 Million require the following in addition to other standard documentation)An expense statement specifying business expenses as a percent of the gross annual sales/revenue prepared and signed by either a CPA or tax preparer; and 12 or 24-months of business bank statements covering the most recent time period and matching the time period covered by the P&L.o 12 or 24 Month P&L Statement ((all loans over $3 Million require the following in addition to other standard documentation)O P&L compiled by either a CPA/accountant or licensed taxpreparer; and12 or 24-months of business bank statements covering the most recent time-period and matching the time-period covered by theP&L.o 12 or 24 Month borrower prepared P&L statement: (all loans under $3 Million require the following)P&L prepared and signed by the borrower; andA business narrative provided by the borrower which includes detail regarding the size and operating profile of the business addressing; location/rent, number of employees/contractors,The Mortgage Approval Process For Applicants Who Are Self Employed When you are refinancing or buying a Texas home, there will be a series of specific steps that you will need to go through in order to qualify using bank statements only for income..First of all, you will need to apply for a loan. You can do that by telephone, online, or in-person. Usually, the loan processor or officer will verbally take your information and submit it to an automated underwriting system (AUS). Normally, you won’t need to fill a lot of forms out. However, you will need to document your income, any investment/retirement/savings balances, and all of your debt. Lenders will run a credit check and want to know about your employment history.Underwriting Texas Self Employed Mortgage Applicants Who Are Self Employed Based on the information that you provide, a response will be generated by the underwriting system within minutes, either declining, approval or referring your loan to be underwritten by a human. The human underwriter will then take over. If you are approved by the AUS, your documents will be checked by the underwriter to ensure they match the information that is on your application. For example, if you stated that you earn $6,000 per month, then your tax returns or W-2s should match that number. Also, your bank statements should match the amount that you say you own. If the system declines your loan or cannot make a decision, then a human will look at your application to see if you qualify under their manual underwriting guidelines.Only Taxable Income Is Considered By Almost all Texas Mortgage Lenders What often trips up a Texas Self Employed mortgage applicant is they may state they earn $200,000 per year. However, their taxable income may only show $40,000 per year. A somewhat complicated form is used by underwriters to come up with what is called “qualifying” income for Texas Self Employed mortgage applicants who are self-employed. They start off with your taxable income and then certain deductions such as depreciation are added back in since they are not actual expenses coming directly out of your bank account. However, they may also subtract “windfall” or “extraordinary” income. If an income source doesn’t seem to be ongoing and stable, then usually it cannot be used to qualify to get approved for a home loan.Other Supporting Documents Lenders will also review your assets, to ensure the down payment is coming from a source that is acceptable. They don’t want you cleaning your business account out for your down payment, for example, since that could jeopardize your livelihood.They also want to ensure that you don’t have any undisclosed loan. So, for example, if an unusually large deposit was made to your bank account within the past 60 days, the underwriter might ask you to prove the money’s source. You might need to provide additional documentation as well, at the underwriter’s discretion, such as a statement fro your accountant or a business license.Credit Approval After you have been given the green light by the human underwriting, you will have been approved for credit, meaning you, the borrower has met the lender’s guidelines and will be able to close on a property as long as it complies with the requirements of your lender. However, the underwriting process will vary from one applicant to the next and from one loan to the next as well. Underwriters may require various documents for each mortgage borrower who is self-employed.How long do you need to have been self employed in order to obtain a mortgage?In order to obtain a mortgage, you might not need to show a self employment history of 24 months. For example, Fannie Mae states that you might qualify with self employment of 12 months if you have prior experience in your field, and you have income that is much or more of what you earned in the field prior to becoming self-employed.Mortgages For Texas Self Employed Texas Self Employed mortgage applicants Who Are Self Employed Fannie Mae has allowed for a looser set of guidelines to be used for the Texas self employed Texas Self Employed mortgage applicants. There are three areas that are encompassed in the policy updates:

SELF-EMPLOYED 12 or 24 MONTHS BANK STATEMENTS DOCUMENTATION

SELF-EMPLOYED 12 or 24 MONTHS BANK STATEMENTS DOCUMENTATION